What the Coronavirus (COVID–19) Means for African Family Farmers and Fishermen

Release Date: 14th April 2020

Table of Contents

1. Impact of COVID–19 on Africa’s Agricultural Production

i) Disruption in Global Supply Chains

ii) Farmers & Workforce

iii) Locusts in Time of Pandemic

iv) Food waste

2. Laws, Regulations & Restrictions

i) Tax Laws, Tariffs & Incentives

ii) Border Restrictions, Curfews, Lockdowns and Logistics Constraints

3. How COVID–19 has Affected Supply & Demand of Africa’s Agricultural Produce:

A brief of the situation across different countries:

4. Africa’s Agricultural Sectors with Most COVID–19 Risk Exposure

i) Fish and Seafood.

ii) Fresh Fruits, Vegetables and Berries

iii) Cut Flowers and Ornamental Plants.

5. African Countries’ Agricultural Exports COVID–19 Risk Exposure

1.Morocco

2. Kenya

3. South Africa

6. A Look into the Future of Africa’s Agriculture, Beyond the Current COVID–19 Pandemic

i) Processing and Value Addition

ii) The Rebirth of the Cooperatives’ Movement and Cottage Processors among African Family Farmers

iii) Agri-food E-Commerce for Smallholder Market Access

iv) The African Continental Free Trade Area (AfCFTA) and Family Farmers

v) Concentration and Optimization of Value Chains

Executive Summary

In this new report, “Impact of COVID–19 on Africa’s Agriculture: What the Coronavirus (COVID–19) Means for African Family Farmers and Fishermen”, Selina Wamucii, highlights new developments that will shape the food and agricultural landscape across Africa for years to come. This report gives a most-recent and ground-up perspective on how the pandemic is affecting African farmers, and focuses on:

- The impact of COVID–19 on Africa’s agricultural production

- How laws, regulations & restrictions during the COVID–19 pandemic are affecting agricultural markets

- How COVID–19 has affected supply and demand of Africa’s agricultural produce

- A highlight of Africa’s agricultural sectors with the most exposure to COVID–19 risks

- Analysis of African countries’ agricultural exports with the most COVID–19 risks

- A look into the future of Africa’s agriculture, beyond the current COVID–19 pandemic, and what it means for the region’s family farmers.

Selina Wamucii is the platform for food and agricultural produce from Africa’s agricultural cooperatives, farmers’ groups, agro-processors and other organizations that work directly with family farmers across 54 African countries.

1. Impact of COVID–19 on Africa’s Agricultural Production

African agricultural production has not yet been directly hit by the COVID-19 pandemic, at least in the immediate term. However, agricultural production and productivity across different African regions and countries will be affected in the coming months as a result of factors that are slowly coming into effect, described as follows:

i) Disruption in global supply chains

Family farmers need quality seeds, fertilizers, and crop-nurturing and protection inputs and implements to achieve good production in their farms. They need packaging materials too for post-harvest handling and dispatch of the produce to markets.

Currently, there is a global disruption of supply chains and this is affecting the import of agricultural inputs from Asia, Europe, the Middle East and other regions.

While countries and farmers may have enough stock of fertilizers, chemicals and other implements to last them a few months, if the situation persists and they are not able to receive input shipments from China and other countries, then the situation will turn dire.

ii) Farmers & Workforce

There is great concern as to how the pandemic will impact farmers and agricultural labour across Africa. With African farmers being a relatively elderly demographic, and trends show COVID–19 has a much higher degree of severity among older age groups, so there is definitely a risk that if the pandemic hits rural Africa, many of the farmers would be at high risk and this would affect production.

Another factor to consider is that up to 70% of Africa’s food is produced by women, who are also primary caregivers across many of Africa’s rural regions. This means that a key segment of the agricultural workforce across Africa is at a higher risk of contracting COVID–19, as they also take care of their families and communities.

Smallholder farmers need to be equipped with means of protection, being a vulnerable group that is also vital to food security across Africa. Other agricultural workers, for example packhouse workers, are also at high risk given that most packhouse packing line configurations make social distancing measures very difficult to comply with.

iii) Locusts in time of Pandemic

Before the COVID–19 pandemic, farmers in East Africa were already suffering severe locust invasion and now COVID–19 has worsened the situation. The U.N. Food and Agriculture Organization (FAO) has warned that a new wave of locust swarms are starting to form, representing an unprecedented threat to farmer livelihoods – specifically in Kenya, Ethiopia and Somalia, where widespread breeding of locusts is currently in progress. As a result, farmers are facing a double catastrophe from the impact of COVID–19 and the locusts at the same time, a combination that will negatively impact on their farm yields.

iv) Food waste

Amidst the uncertainty during the COVID–19 pandemic, matching supply with demand is becoming a major problem, especially given the logistics bottlenecks arising from lockdowns and restricted movement. This is likely to compound the food loss problem that was a major problem across African food value chains before the pandemic. For perishables like milk, fruits and vegetables, this will lead to waste and losses that the already vulnerable farmers can simply not afford to absorb.

2. Laws, Regulations & Restrictions

i) Tax Laws, Tariffs & Incentives

Several African countries have recently passed laws and regulations to help ease the impact of COVID–19.

Kenya has reduced VAT from 16% to 14%, while Tunisia, Uganda and Nigeria have increased timelines for tax filings while expediting VAT credits.

All these measures are likely to help reduce the cost of agricultural inputs while also benefiting agro-businesses. Export-oriented agricultural firms will also benefit from the expedited VAT refunds and credits meant to help them cope with the resulting operational stress.

South Africa’s National Treasury has introduced a new tax subsidy of 500 rand ($28) per month for each worker for four months to ease the burden of financial losses due to the coronavirus.

Some laws enacted, though not directly related to COVID–19 but passed during this period, have the potential of affecting farmers during the COVID–19 pandemic. Kenya has introduced a 10% import levy on dairy products which would affect milk imports from Uganda, a major exporter of milk to Kenya.

ii) Border Restrictions, Curfews, Lockdowns and Logistics Constraints

With the logistics sectors being adversely affected, this is hampering agricultural produce exports and imports.

So far 31 countries across Africa have imposed full border closures, while a majority of the others are allowing only cargo and basic goods through. South Africa has closed 35 land borders, as well as two seaports from mid-March.

Uganda not only suspended all passenger flights but also closed its land borders with an exception of cargo flights and cargo vehicles. Kenya suspended all international flights from March 25 with the exception of cargo flights. Ghana, Ethiopia as well as many other African countries have closed all land borders.

Key border and trade facilitation agencies across Africa have also implemented preventive measures, including a reduction in the number of staff leading to lower capacity. As a result, importers and exporters are faced with technical challenges, especially around inspections and documentation. This is also compounded by delays caused by stringent medical screening of truck drivers at border points, and delays in vessel clearance to dock at different ports, as follows:

- Truck delays at the border due to screening resulting in delayed deliveries to clients and/or delayed return to ports.

- Lockdowns and curfews affecting transit time and also affecting loadings at the port.

- Challenges of moving some key operations online within a short time, e.g. online submission of documents, as well as the use of emails, in place of physical documents.

- Closure of Internal Container Depots and restriction of movement.

For agricultural exports, all the new measures will translate to additional logistical costs likely to affect the competitiveness of the produce in the destination markets, not to mention losses of perishables, amidst very uncertain times for commerce.

For import of agricultural inputs, logistical constraints will result in, among other negative consequences, limited access to inputs, animal feed, and diminished capacity of packhouses and slaughterhouses.

For air shipments of fresh fruits and vegetables (FFV), flight cancellations will mean limited or no market access at all for African FFV farmers, especially to European and Chinese markets.

These restrictions also have an effect on the domestic prices of various products. A ban is in place in Algeria affecting the export of various essential agricultural produce including coffee, dairy products, fresh fruits and vegetables, pulses, meat and poultry. In Morocco, the government has suspended the customs fee on all soft wheat imports until mid-year. In East Africa, amidst the closure of the Kenya–Uganda border, the prices of maize and eggs have risen by 15 and 5% respectively in Kenya, caused by the cut-off of supplies from Uganda.

3. How COVID–19 has Affected Supply & Demand of Africa’s Agricultural Produce

African countries are seeing lower demand for their produce across export markets.

The drop in demand varies by destination market and produce types, with FFV, berries, meat and seafood seeing the most drastic drops.

A brief of the situation across different countries:

- South African lobster exports to China, which imports over 90% of SA’s lobster catch, have come to a complete standstill, affecting thousands of fishermen and their families.

- Across the European Union, the largest export market for Africa’s fresh fruits and vegetables, demand has dropped for popular produce, including Kenyan avocados, green peas and beans; South African citruses and Moroccan vegetables.

- Kenya has recorded an 8.5% decline for tea exports in various global destinations like Iran, Pakistan and UAE.

Kenyan and Ethiopian fresh cut flower exports have been adversely hit. - Ghana’s cashew prices have recorded a 47% drop in prices as demand for cashews in the domestic market and also neighbouring countries like Ghana, Côte d’Ivoire and Nigeria, has gone down.

- Container shortage will most likely affect Uganda’s coffee beans exports.

- Demand for cocoa beans from Africa has reduced across Europe.

4. Africa’s Agricultural Sectors with Most COVID–19 Risk Exposure

i) Fish and Seafood.

Africa’s fishing industry is one of the hardest hit. After Senegal closed its land, sea and air borders in March, the country’s fish can no longer be exported to Italy and other European countries. Just like Senegal, South Africa’s fish and seafood catches can no longer be exported to Europe and China, a major market.

Given that fishing is a source of food and livelihood for many African coastal and island countries, this industry was already on a decline – caused mainly by unsustainable and destructive fishing practices – and the COVID–19 pandemic will bring an already fragile industry to its knees.

ii) Fresh Fruits, Vegetables and Berries

Fresh fruits, vegetables and berries are labour-intensive crops and likely to be affected by labour disruptions caused by sickness, lockdowns or social distancing requirements. Logistics interruptions are also likely to lead to losses given high perishability.

iii) Cut Flowers and Ornamental Plants.

Cut flowers and ornamental plants across Africa, especially Kenya and Ethiopia, are going to be among the hardest hit sectors by the COVID–19 pandemic. Low demand, low prices and logistics disruptions are going to necessitate the downsizing – if not outright closure – of many businesses.

5. African Countries’ Agricultural Exports With Most Exposure to COVID–19 Risk

The COVID–19 pandemic is affecting the food and agriculture exports in all African countries with varying degrees of exposure, as follows:

1. Morocco

Morocco tops the list of African countries whose agricultural exports face the highest risk.

This is largely due to the over-reliance of Morocco on the European market given its close proximity and well-established traditional trading ties.

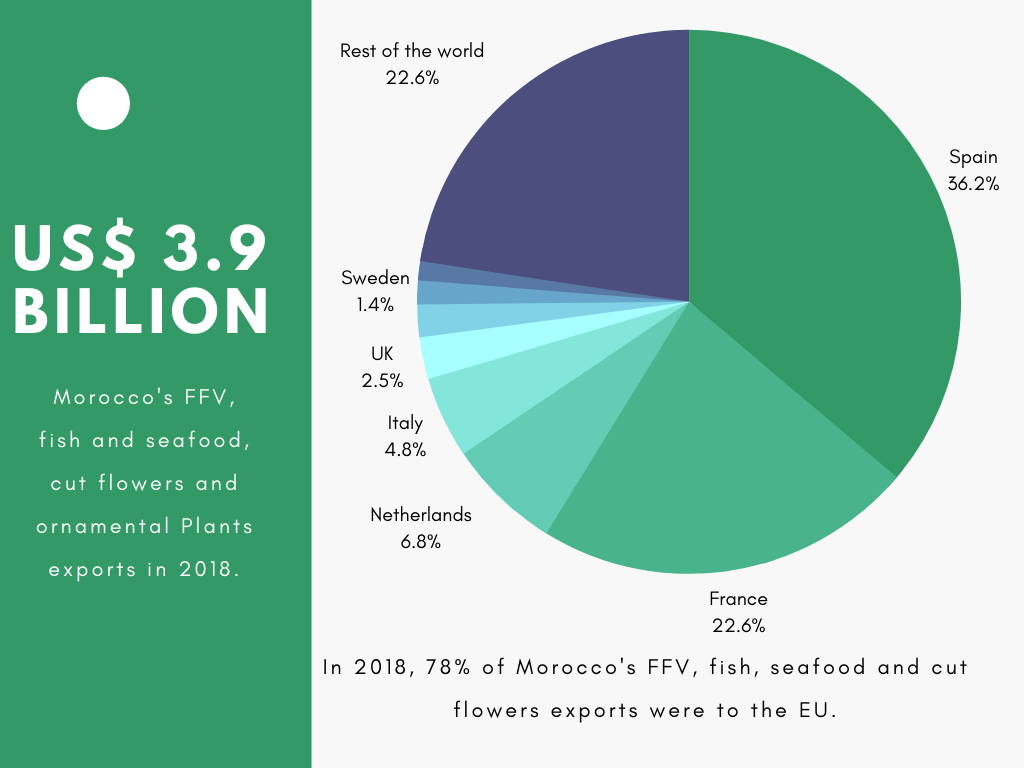

In 2018, Morocco’s FFV, fish, seafood and cut flowers, worth $3,024,724,000 was exported to the European Union, translating into over 78% of the FFV, fish, seafood and cut flowers worth $3,846,083 exported by Morocco to the rest of the world in that year.

The top importers of Morocco’s agricultural produce are Spain, France, Netherlands and Italy; all countries whose markets have been disrupted. In 2018 alone, Spain imported $735,321,000 worth of fish and seafood, approximately 53.7% of the total fish and seafood worth $1,363,737 exported by Morocco in that year.

2. Kenya

Kenya’s agricultural exports also face a great risk of being affected by Coronavirus-related disruptions. This is mainly due to the over-reliance of the country on fresh cut flowers’ exports, the bulk of which end up in the European Union. In 2018 alone, Kenya exported $625,784,000 worth of fresh flowers, over 76% of which went to European Markets. Kenya’s flower exports have so far recorded a more than 50% drop in exports with indications that production is currently at less than 10% and facing the risk of total collapse.

Additionally, over 50% of Kenya’s FFV exports and nuts go to the European Union and China, which are markets that have already been shaken up. In 2018, Kenya’s FFV and nut’ exports worth $223,113,000, out of the total $482,559,000 exported, went to European markets.

In terms of production, as Kenya grapples with these disruptions, the country is also under siege by the worst infestation of desert locusts in 70 years, decimating crops mainly grown by family farmers and wreaking havoc on production.

3. South Africa

While the agricultural production in South Africa has not been adversely affected by the Coronavirus pandemic, logistics and border restrictions are likely to affect South Africa’s agricultural exports. The country has closed 35 land borders and two seaports. Coupled with the fact that the county also has prohibited crew changes in all of its ports amidst a looming container shortage, the export volume is bound to go down especially for fish, seafood and fresh vegetables.

South Africa’s fish and seafood exports in 2019 were $497,478,000, out of which $362,284,000 was exported to markets that have been hugely disrupted by COVID–19 including Spain, Italy, and China.

Likewise, fruits and nuts exports were $3,416,711,000 in 2019, 55.4% of which was exported to Europe and China.

Other Countries

Other African countries that will experience significant drops in the FFV, fish and seafood exports are, in order of the projected severity: Tunisia, Senegal, Cameroon, Uganda, Mauritania, Tanzania and Egypt.

6. A Look into the Future of Africa’s Agriculture: Beyond COVID –19

There are changes taking place across Africa’s food and agricultural sector that will endure for a long time past the COVID–19 pandemic. As such, the agricultural landscape will change in a number of ways, some that are already evident or underway. In the brief below, we look at different ways Africa’s food and agricultural sectors will change as a result of the pandemic.

i) Processing and Value Addition

As more countries focus on ensuring critical supply chains are not interrupted again during a pandemic like COVID–19, one likely outcome is that countries will seek to have control of their own food production, and reduce reliance on cross-border imports – especially for food items. This is because when food supply chains are broken by closed borders, countries will seriously weigh the risks that go with relying on other countries to feed themselves.

While countries within the EU block, for example, might not be drastically affected by such a policy change, such a policy change will no doubt negatively affect African countries that export raw and unprocessed fresh produce to the EU and other markets.

In light of such changes, African countries will focus more on developing their value chains, including processing and value addition, if their agricultural sectors are to survive.

To compound this, industries that import agricultural raw and semi-processed materials will have to assess the impact of supply chains being broken by closed borders, and therefore negatively impacting their own production. To reduce the supply chain risks, more processors might consider moving their processing closer to the production areas, as opposed to thousands of miles away, as is currently the case with coffee beans and other raw or semi-processed items like cashews, cocoa beans and macadamias.

ii) The rebirth of the cooperatives’ movement and cottage processors among African family farmers

Before the COVID–19 pandemic, African smallholder farmers were already a severely vulnerable population, exposed to extreme poverty, hunger and the effects of climate change. Given their already vulnerable position, with little if any cushion from a global pandemic, these farmers will suffer more from the immediate, short- and long-term effects of the COVID–19 pandemic, compared to any other group on the continent.

What this pandemic will expose is the lack of reliable channels to deliver much needed support during such crises; from cash transfers, to inputs and market access for their produce during a time of depressed markets and logistical nightmares. The smallholder farmers who will fare better are those that are already organized into functional cooperatives or groups. The cooperatives are an extremely effective vehicle through which governments and other partners can provide support to rural farmers. Post-COVID–19, the cooperatives are also very key to supporting enhanced production and productivity, value-addition, and also market-access for smallholder-grown produce while also providing a safety net against market effects during a time like this.

Most importantly, the cooperatives offer the only true and tested way out of poverty for smallholder farmers – through commercialization of rural agriculture, value-addition and market access. Post COVID–19, cooperatives offer a strong avenue to mobilise and empower farmers through training, access to inputs, credit, and the benefits of economies of scale derived from market access.

Cooperatives, now more than ever, offer smallholder farmers a chance for the much-needed shift from informal to formal, lifting one another to new economic heights.

iii) Agri-food E-commerce for Smallholder Market Access

It is becoming increasingly clear now that e-commerce is no doubt going to be an important channel for market access for farmers across the world. With social distancing measures coming into play, ecommerce is a reliable additional channel for market access for farmers. While agri-food ecommerce has already shown substantial success in China, e commerce gives a signal as to how African farmers will access markets in the future.

Market access-specialized platforms and marketplaces for farmers across Africa, like Selina Wamucii, are going to facilitate the trend of more and more food and agro purchases moving online, amidst the COVID–19 pandemic.

Agri-food E-commerce is also going to be fueled by the shift to cashless transactions, including mobile money, something that has been a missing ingredient in African commerce.

iv) The African Continental Free Trade Area (AfCFTA) and family farmers

According to the United Nations Conference on Trade and Development, intra-African trade was around 2% during the period 2015–2017, while comparative figures for America, Asia, Europe and Oceania were, respectively, 47%, 61%, 67% and 7%. Looking at exports, the share of exports from Africa to the rest of the world ranged from 80% to 90% in 2000 –2017.

The high rate of African export dependence, in the time of COVID–19, when many countries are implementing border closures and restrictions, is one that calls for the continent to rely less on external commerce. It is clear now that African countries have to trade with themselves way more than they are currently doing.

With COVID–19 severely disrupting trade in key markets for Africa’s agricultural produce, African farmers are bound to experience an export market access nightmare like no other. Now, unlike no other time, can we see the demonstration of why the success of the African Continental Free Trade Area (AfCFTA) will be directly linked to securing the livelihoods of African farmers.

With the commencement of trading under the AfCFTA on July 1, 2020, this will create a single continental market of more than 1.3 billion people, with a combined annual output of $2.2 trillion. The transition phase to the Continental Free Trade Area alone is estimated to boost intra-African trade by 33%.

COVID–19, no doubt will demonstrate why the AfCFTA is a necessary intra-African trade-revitalizing initiative, to be pursued with great resolve and commitment to make it a success.

v) Concentration and Optimization of Value Chains

Agricultural value chains across Africa are highly fragmented, leading to a lot of inefficiencies, high costs and bottlenecks along the value chain. In the wake of additional logistics hurdles caused by COVID–19, the value chains will have to undergo reinvention to eradicate these inefficiencies.

To reach our thousands of family farmers, contact us through:

This report is available under the Attribution-ShareAlike 4.0 International (CC BY-SA 4.0) license and allows users to freely copy, reproduce, reprint, distribute, translate and adapt the work for non-commercial purposes, on condition that Selina Wamucii is acknowledged as the source using the following suggested citation: “Impact of COVID-19 on Africa’s Agriculture: What the Coronavirus (COVID-19) Means for African Family Farmers and Fishermen