Keen to boost production and advance livelihoods, Kenya on October 8, 2025 proposed a farmer-accessible global auction for local produce, especially coffee.

The Cabinet Secretary in the Ministry of Agriculture & Livestock Development Mutahi Kagwe isolated coffee as the starting point.

In the first rank of priorities is the digitization of the Nairobi Coffee Exchange (NCE) before other crop platforms can follow.

So as to bring worldwide buyers one-on-one with local producers, “the [auction’s] preparations are in their final stages,” said the ministry.

Upon completion, the online hub will reduce brokers who have for decades come between farmers and importers.

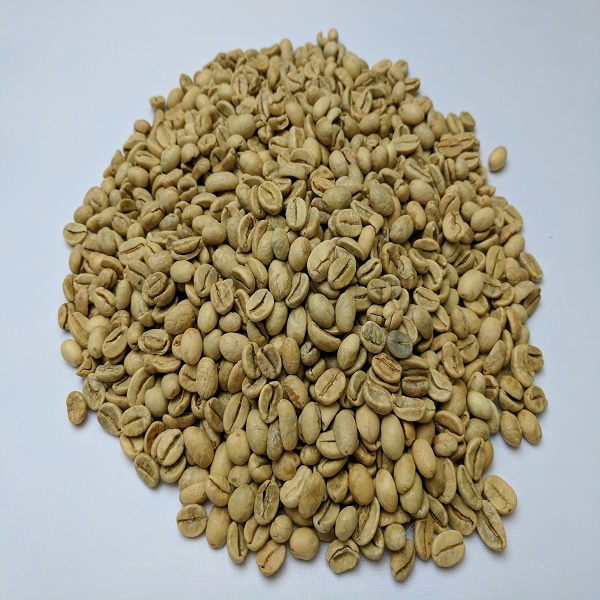

By establishing a global market hub for local green coffee, the country aims to open up its NCE to global players. The exchange currently sells 80% of Kenya’s coffee exclusively via domestic traders representing coffee estates.

Perhaps this is why Kagwe promised market freedom from cartels, with technology bringing transactional transparency towards decent producer prices.

In transition to that, the government has erstwhile upgraded farmers’ payments to the Direct Settlement System (DSS).

With 200 co-ops joining it before October 2025, the Cooperative Bank’s DSS has been transferring 80% of earnings directly to farmers.

Triple Production Vision

Also important to the breakthrough is the redemption of production from its current trickle of 48,700 tonnes (2023) to thrice that value.

According to the Cabinet Secretary of Cooperatives & MSMEs Development Wycliffe Oparanya, Kenya targets 150,000 tonnes in coffee output by 2028.

Some 1,176 co-op factories have already iterated their machinery to boost their capacities in readiness.

If its production vision bears fruit, the East African nation will surpass its annual harvest average of over 100,000 tonnes in the productive 1980s.

A key to success is rekindling cultivation interest in the 0.8 million smallholders who live on the crop.

Starting in the 1990s, farmers in especially Kiambu near the capital Nairobi lost interest in coffee and turned to urban developments.

Also in the picture are economic gains: before the current ministerial statement, coffee exports generated 38.4 billion shillings ($297 million), as of 2024. These earnings might improve following this latest development. Coffee Kenya might even recapture its fading glorious production history, per the following statistics.

Kenya Coffee Historical Production Statistics

After independence in 1963, Kenya used to be in the top echelons of coffee producing-nations. Its output peaked historically in 1988 at 122,700 tonnes, according to the FAOSTAT. Beginning the 1990s, however, the harvest prominence gradually slipped as urbanization took over coffee fields. By 2023, the country was averaging below 51,900 tonnes in its green coffee harvest, at position 23rd worldwide.

The following table, mined from the FAOSTAT, highlights the golden years vis-á-vis 2023:

| Year | Production [tonnes] | Annual Growth |

| 2023 | 48,700 | – |

| 1990 | 103,900 | -12.51% |

| 1989 | 116,900 | -10% |

| 1988 | 128,700 | 22.94% |

| 1987 | 104,679 | -8.83% |

| 1986 | 113,926 | 21.71% |

| 1985 | 93,600 | -26.6% |

How many smallholder coffee farmers are there in Kenya?

Kenya averages 800,000 small-scale coffee growers who represent 65% of national supplies, according to the World Coffee Research. This number comprises hundreds of thousands of households and individual farmers with less than 5 acres of land. The rest of the national coffee supply comes from large private estates.