Robust coffee demand drove late 2024 auction prices at the Nairobi Coffee Exchange (NCE) to record 859.40 shillings ($6.60) per kg.

Helpfully, dry weather effect on Brazil’s and Vietnam’s crops rallied international prices to a historic $3.3545 a pound (7.37 per kg).

This strong international price was a windfall for Kenya’s coffee estates, just then beginning their October harvest.

And since that time, NCE auction tallies have been showing rising momentum in gross earnings and weekly prices.

A February 2, 2024 report showed that in the October 2024-January 2025 period, farmers grossed 11.9 billion shillings ($91.7 million).

In the price department for December 2024, the highest price was $390 (50,584 shillings) per 50 kg, or 1,007 ($7.8) per kg.

While the December average was $318 (41,245 shillings) or $6.60 (859 shillings) per kg, the trade price range was substantially wide. Offers at the Nairobi auction shuffled between $155 and $390 (20,104-50,584 shillings) per 50 kg each week of the month.

NCE’s Transaction Fees at 1.8%

Additionally, currently low transaction fees could improve earnings in coming weeks if demand sustains.

The Capital Markets Authority lowered auction service fees to 1.8% in early February 2025, a savings boon for coffee marketers.

Coffee Demand Brings $91.7 billion

Despite coming before the service fee reduction, the total producer earnings from October 2024 to January 2025 were quite substantial.

At nearly 12 billion shillings ($91.7 million), the 4-month period’s returns came from 16 auctions arraying 243,419 bags.

The top three best-earning estates and cooperatives transacted up to 25,663 bags apiece during the timeline.

Farmers in the Lurch

Notably, farmers indirectly received below par prices at a maximum 111 shillings ($0.86) per kg due to broker surcharges.

Kenya has been endeavoring to help farmers raise their earnings by eliminating middlemen and offering direct export windows for cooperatives.

In October 2023, for instance, the government allowed farmers for the first time into NCE’s direct sales.

For now, however, it is all about uptick coffee demand and how it is reviving Kenya’s coffee economy. To learn more on the coffee sector in Kenya, read the statistics below.

Kenya Coffee Demand, Production and Trade Statistics

Kenya is one of the top 10 coffee-producing nations in Africa and a top 25 world producer. According to FAOSTAT, the East Africa country produced 51,900 tonnes of coffee in 2022, the 23rd highest worldwide. In 2023, the value decreased by -6.17% to 48,700 tonnes, a time when trade policy headwinds were rocking the sector. Overall, Kenya represents 0.6% of global production and fluctuates between production ranks 17 to 23 worldwide, year-on-year.

Although Kenya’s coffee sector satiates mainly foreign demand, local demand is still high as reflected in uptick consumption. Domestic consumption rose steadily from 509, 900 kg in the 2015/16 market year to 1,500,000 kg in the 2019/20 period.

In terms of exports, Kenya ranks 25th worldwide with earnings of $260.983 million, as of 2023. This is a sixth of the earnings by Africa’s export leader, Ethiopia ( $1.2 billion) and a quarter of Uganda’s $831.655 million.

Leading destinations of Kenya’s coffee include Germany (21.5% of exports), the United States (14.4%) and Sweden (10.1%), for 2023.

Does Kenya import coffee?

Kenya imports around $9.34 million in coffee per year (2023), according to OEC. This represents around 28.9% proportion of the country’s total exports. In 2023, 72% of imports came from the Democratic Republic of Congo ($3.26 million) and Uganda ($3.04 million).

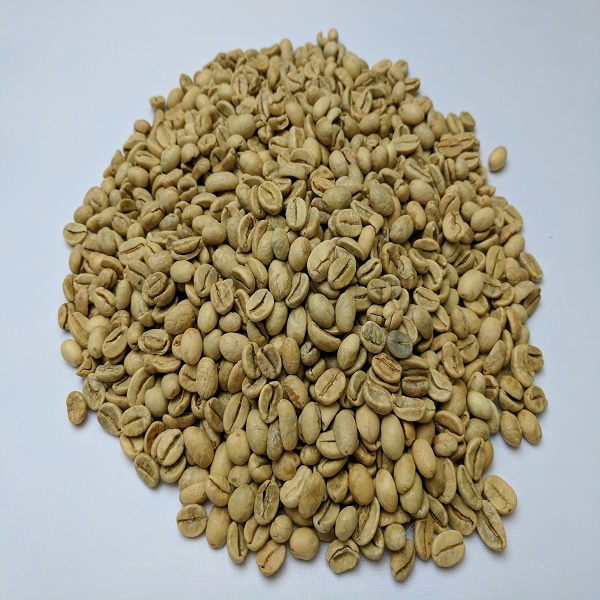

Which are the coffee grades in Kenya?

Arabica is the exclusive variety of coffee in Kenya and has at least seven market grades. These include, from the lowest to the highest, MH/ML, T, TT, AB, AA, PB and E beans. AA is the most popular grade in international markets.