Olive oil production shifts have lately been shuffling the world’s runner-up position between Tunisia and Italy but now the North African country is almost certainly number 2.

According to the Arab Press on January 8, 2026, Tunisia might produce 500,000 tonnes of olive oil in 2025-26, up 50% annually.

Official estimates however put 2025-26 output at 380,000-400,000 tonnes, which still surpasses Italy’s 2025-26 projection of 300,000 tonnes.

Since the olive sector is prone to sharp changes due to weather, ranking can change drastically. For instance, Italy in end 2025 had slipped to the 4th position worldwide after Greece, Tunisia and Spain, before reclaiming the third slot.

According to Il Sole 24 Ore, Italy used to average 800,000 tonnes per year before 2000 – an example of sharp production fluctuations.

Stable Production in the Maghreb

This is not strictly true of Tunisia, which in recent years has been pressing uptick volumes of the oil through mechanized means.

In the 2024-25 timeline, extracted volumes grew by 41.3% yearly to 288,600 tonnes, albeit turnover fell by 28.4% from a price crash.

Just two seasons beforehand (2022-23), Tunisia had upped its processing capacity to 217,000 tonnes, to rank 5th worldwide.

It took only a season more for the country to improve production rankings as the 4th largest olive oil origin, representing 10% of global supplies. By end 2025, it was the 3rd largest, having earned 4.5 billion dinars ($1.544 billion) for the January-August 2025 period.

The only area with no stability is price, whose controlling forces are mainly international factors due to export orientation.

Between November 2024 and September 2025, average export prices from the North African country slumped by 46.2% annually, to 9.28 dinars ($3.19) a liter.

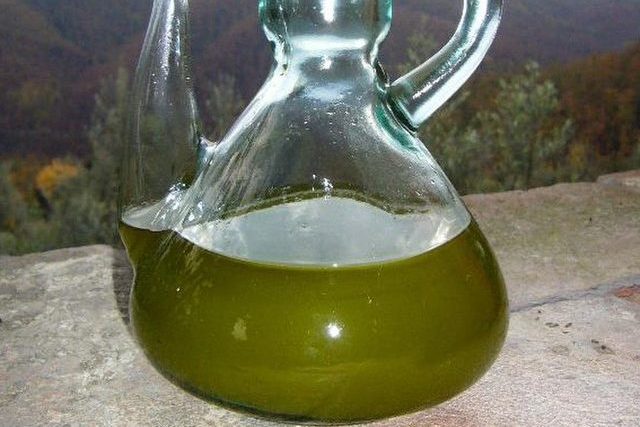

Tunisia nevertheless boasts high quality olive oil exports, with 77.7% of all exports in the 2024-25 season passing as extra-virgin. The below stats follow up on similar tidbits that characterize this key export.

Tunisia Olive Oil Statistics

Tunisia is a major supplier of olive oil, with a 10% world production share. The commodity represents 53% of annual national agri-food shipments. Most exports go to competitor Spain, which received 26.7% of shipments in the initial 11 months of the 2024-25 campaign. Italy, another competitor, also remained the top importer of Tunisia’s organic olive oil in the same period with a 51.1% share.

Despite seasonal fluctuations, olive and olive oil production fuel the giant sector. The olive harvest last peaked in 2020 at 2 million tonnes, while olive oil attained 399,900 tonnes the same year. The following data interpretation from the FAOSTAT recounts 2020-23 highlights:

| Year | Olives [tonnes] | Olive Oil [tonnes] |

| 2023 | 1,093,462 | 210,000 |

| 2022 | 1,200,000 | 235,200 |

| 2021 | 700,000 | 144,200 |

| 2020 | 2,000,000 | 399,900 |

How much does Tunisia earn per liter of olive oil?

Fluctuations in international markets affect the average prices of olive oil from Tunisia. In the 2023-24 season, the price averaged 17.9 dinars ($5.94) a liter while in 2024-25 it plummeted to 9.28 dinars ($3.19) due to a global surplus. Organic oil however asserts a robust price at between 13.81 dinars ($4.74) a liter for bulk and 17.06 dinars ($5.86)/l for packaged oil, as of September 2025.