The November 2025 FAO food price index (FPPI) that tracks prices of global dainties dipped to 125.1 points, the lowest since April.

November registered a 2% fall in the index month-on-month from the final October value of 126.6 points.

The decrease is the third consecutive since September (128.5 points), indicating slowing inflation and gaining production among nations.

November’s value decreased on account of declines in market quotations of nearly all food categories other than cereals.

Leading the decrements was vegetable oil at 165 points or 2.6% down from October, itself the lowest in five months.

Palm oil rates decreased due to surplus production in Malaysia while those of canola oil retreated from positive output forecasts.

A similar situation informed the November meat index at 124.6 points or 0.8% below October’s.

Although up 4.9% annually, the monthly index’s dip seemingly escaped pricey bovine cuts in places like the United States.

Poultry and pork prices however countered stability in beef to bring the value considerably down.

Sugar meanwhile declined for the third month in a row, reaching its cheapest level since December 2020 at 88.6 points.

Its monthly value fell sharply by 5.9% and annually by 29.9%, underpinning 2025-26 sugar production surplus forecasts in Brazil and India.

The last time the sweetener reasserted itself in 2025 was March when it broke even from the previous month.

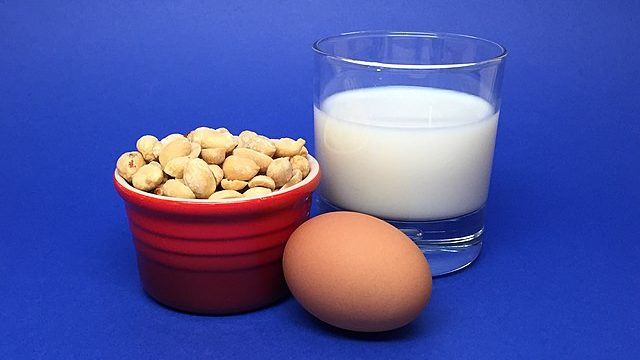

In the same club were dairy prices, down to 137.5 points this November, versus 141.9 points in October.

This fifth monthly consecutive pricing fall reflects glut in seasonal milk in Oceania and butter/skim milk largesse in the European Union.

Cereals only Exception

Among the five categories of global food prices, only cereals improved to 105.5 points – by 1.8% monthly and 5.3% annually.

Wheat asserted the improvement despite an impressive North America’s fall harvest, with similar prospects in Argentina.

The FAO opines that worldwide wheat rates got rescue from glut bearishness by a return to purchases by China for the U.S.’ crop.

Perhaps this is why wheat rates spiked by 2.5% monthly in November, with further support from a renewing Russia-Ukraine war.

Rice lost by 1.5% in monthly prices due to abundant harvests in the northern hemisphere while sorghum and barley gained slightly.

The next FFPI will be on January 9, 2026 and will be a good indicator of how the new year will be shaping up. In anticipation, the following data section compares three different indexes that track worldwide food rates.

Global Food Prices Statistics: a Comparison

Other than the Food and Agriculture Organization (FAO), the World Bank and the Fed Bank of St. Louis all track world food rates. For the FAO Index, here is how 2025 transpired:

| Month | FFPI [value points] |

| May ‘25 | 127.1 |

| June ‘25 | 128.1 |

| July ‘25 | 129.8 |

| August ‘25 | 129.8 |

| September ‘25 | 128.5 |

| October’25 | 126.4 |

| Nov’25 | 125.1 |

The World Bank, on the other hand, showed food prices as expensive in January but cheapest in July and October. This is courtesy of the following data interpretation from YCharts:

| Month | World Bank’s food price index [value points] |

| Jan ‘25 | 115.05 |

| June ‘25 | 106.74 |

| July ‘25 | 107.82 |

| August ‘25 | 106.78 |

| September ‘25 | 107.16 |

| October’25 | 106.30 |

| Nov’25 | 108.84 |

An additional comparison source is the Federal Reserve Bank, St. Louis, whose global food prices tracker stood as follows by mid-2025:

| Month | Fed St Louis’ global food price index [value points] |

| Jan ‘25 | 135.64 |

| Feb ‘25 | 132.07 |

| Mar ‘25 | 126.97 |

| Apr ‘25 | 129.36 |

| May’25 | 126.20 |

| June’25 | 125.84 |