As Ethiopia navigates a possible 10% tariff by its biggest coffee market, the United States, value addition in the country is improving.

According to the Ethiopian Herald, foreign investors have pooled $10 million since 2022 towards export value addition.

The investments could expand the marginal export share of value added coffee, currently at 1% of the total.

It all starts with promotional campaigns that have been using the hospitality industry to advertise coffee products from local processors.

According to Kassahun Geleta, CEO of Market Development and Promotion at the Ethiopian Coffee and Tea Authority, targets include visiting delegations.

Challenges and Prospects

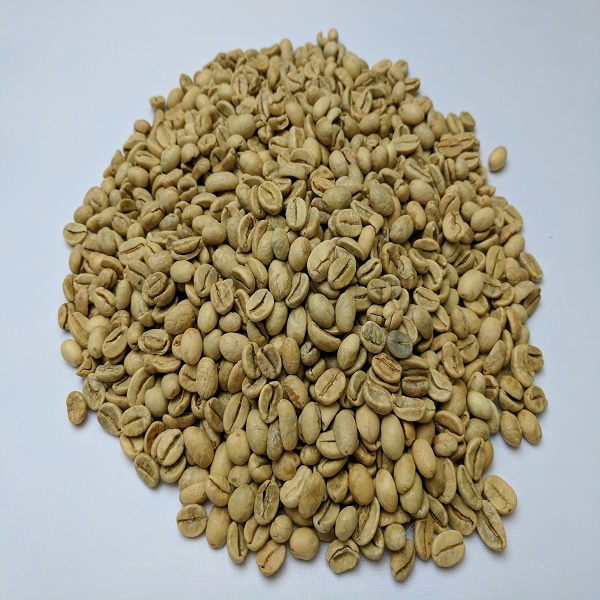

Challenges to value addition include the internationally popular quality beans from Sidamo and other regions, which sell lucratively.

Besides, importers actually do the value addition themselves to gain profit, meaning that they only want to purchase raw beans.

Prospects are there, however, especially in markets such as China, where coffee products are gaining demand.

China currently orders 20,000 tonnes of raw beans from Addis annually, the eighth highest among Ethiopia’s 84 foreign coffee markets.

Helpfully, 100 brands in Ethiopia already export processed products and are paving the way for newcomer investors.

In the 2023-24 market year, value added export volumes from these companies and others rose to 500 tonnes. Although this was a pittance out of the total coffee exports of 298,500 tonnes worth $1.43 billion, they still generated $4.2 million.

This at a time when annual volumes could reach 400,000 tonnes in the 2024-25 market year, according to estimates.

So, as Ethiopia bates its breath for possible Washington’s tariffs after a 90-day moratorium, value addition is gaining. For the bigger picture of Africa’s number one coffee shipper, browse through the statistics below.

Statistics on Coffee Value Addition in Ethiopia

Coffee is Ethiopia’s second biggest export, contributing roughly 1/3rd of all forex revenue. At 19% of all exports behind gold at 21%, coffee is a net earner that annually generates around $1.16 billion (2021). Most of the returns come from shipments of raw beans, with value addition contributing $4.2 million a year (2023).

Is value added coffee in high production volume in Ethiopia?

Value added coffee output in Ethiopia is low, for only 100 companies process it. Annual exports are at 500 tonnes, as of the 2023-24 market year. This represents 1% of the 298,500 tonnes of all coffee under export in the same timeline.

Which value added coffee products does Ethiopia export?

Coffee extracts are some of the related caffeine products that Ethiopia exports. The country shipped $224,000 woth of coffee/tea extracts in 2023, most of it to Ireland and the UAE. This amount contributed to the $1.43 billion the country earned from all coffee shipments in the 2023-24 fiscal year.

Does cost impact value added coffee processing in Ethiopia?

Cost is not a major inhibitor for value added coffee processing in Ethiopia. Indeed, it takes only 8,000 birr ($3.30) or 50% of the April 2025 global production cost to process 1 feresula (17 kg) of coffee locally. The main barrier to processing is the high demand of the country’s quality raw beans internationally.