Egypt is covering a juicing orange gap in Europe at a time when Brazil and the Iberian Peninsula are rushing their harvests.

Hoping to hit 2 million tonnes for the December 2023 to July 2024 season, Egypt is counting on the low-supplied European market. The leading citrus exporter is looking forward to topping the record 1.6 million tonnes it exported in the 2022-23 season.

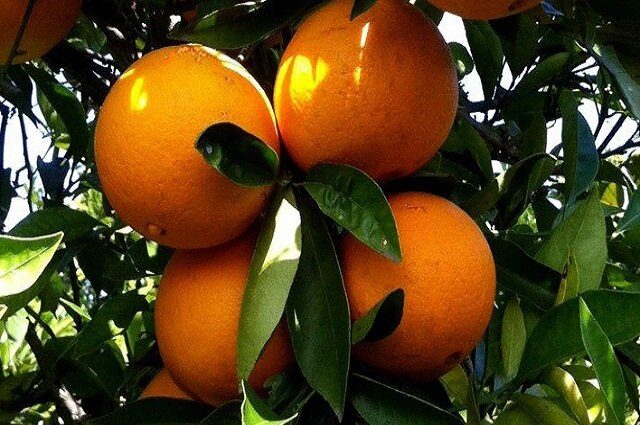

The Egyptian navel and Valencia orange season runs from November to July each year.

Brazil and Spain are meanwhile looking on a future without enough oranges. Greening disease and dry weather are forcing farmers here to harvest their fruits early to contain losses.

Therefore, in all probability, demand for juicing oranges may rise above supplies and affect prices by June 2024.

It is already happening across parts of Europe. Britain is currently coping with rising orange juice prices, now at £1.35 per liter or EUR 1.57, up by 31%.

The price could have been higher were it not for the entry of supplies from Egypt as a stopgap measure.

Harry Campbell of the price analyzer, Mintec, links Egypt with easing supply pressure in the European market in January.

Egypt’s orange prices on the EU market were at EUR 450 per tonne in December 2023, against Spain’s EUR 500.

The cheaper price and the supply input by Egypt helped counteract hikes in farm gate prices for juicing oranges in Europe’s orange groves. Spain’s producers, for instance, raised theirs by between 11 and 15% amid drought in Andalusia.

With Spain out, four European nations are likely to remain in the top 10 of Egypt’s orange export destinations this season. According to USDA’s Foreign Agricultural Service (FAS), these will include the UK, Spain, Russia and the Netherlands.

Indeed, Egypt’s supplies will help rein in rising UK’s orange juice prices and mitigate a decade-long orange juice preference. This fruit drink has accounted for two-thirds of all juice consumption in the country since 2013.